Fixed Income Outlook 2026

How will interest rates, inflation, and credit markets evolve in 2026? What risks and opportunities should investors consider in the fixed income space? Svein Aage Aanes, Head of Fixed Income in DNB Asset Management, shares his outlook on global rates, inflation, credit risk, and the unique position of Nordic bond markets.

Global Interest Rate Outlook: Stability Amid Divergence

What is your baseline view for interest-rate developments through 2026? Should we expect a prolonged period of higher rates, or a faster-than-expected decline in key policy rates?

During 2025, central banks have cut rates, but the timing has varied. The ECB and the Swedish National Bank, the Riksbank, completed their rate cut cycles mainly in the first half of the year, while the Fed and the Norwegian National Bank, Norges Bank, started later and remain in a cutting cycle. We expect no further rate changes from the ECB and Riksbank in 2026. Norges Bank is likely nearing the end of its cycle, with 1–2 cuts expected, the first possibly next summer. Overall, central bank action in Europe is likely to be uneventful in 2026.

The US presents a different picture, with tariff regimes adding uncertainty to both inflation and growth. Signs of a weakening labour market coexist with stubborn inflation. Market pricing suggests close to 1% in cumulative rate cuts by December 2026, but risks are two-sided: less cutting if growth holds and inflation stays high, or deeper cuts if the economy stalls. This could lead to volatility in US rates, though it may not strongly impact European bond rates. In 2025, European rate volatility has been at historic lows, and we expect EUR, SEK, and NOK rates to remain relatively stable in 2026.

5 year rates, very low volatility in European rates in 2025

Inflation Trajectory: Returning to Target—But Not Everywhere

Do you expect inflation to return to “normalised” levels around 2% in 2025/26, or is a structurally higher inflation regime more realistic?

The inflation picture varies. In the Eurozone and Sweden, inflation has largely returned to target levels, with expectations for 2026 at or below those targets. In the US and Norway, inflation remains around 3%, with only marginal declines expected next year. Both are projected to approach target levels in 2027.

Geopolitical Impact: Risk Premiums and Market Resilience

How strongly do geopolitical uncertainties—such as energy policy, fiscal imbalances, or trade tensions—influence risk premiums in global bond markets?

2025 has seen intense geopolitical and political news: ongoing war in Ukraine, unstable US tariff regimes, and political pressure on the US central bank. Despite this, markets have behaved well, except for an initial sell-off around Liberation Day in April. Rate volatility has been low, and credit spreads have remained tight. With growth still adequate, strong household and business balance sheets, and central banks not tightening, 2026 could be another decent year for credit investment, though pricing remains a concern.

Duration Strategy: Neutral Positioning in a Low-Volatility Environment

What duration positioning do you consider appropriate for the upcoming two years?

We maintain a neutral duration position. Volatility in bond rates is expected to remain subdued, especially in Europe and the Nordics. Tactical long/short positions may be taken based on rate movements, but we do not foresee major changes from current yield levels.

Credit Risk Management: Navigating Rising Refinancing Costs

How do you approach credit risk in an environment where refinancing costs are rising and default rates could increase into 2025/26?

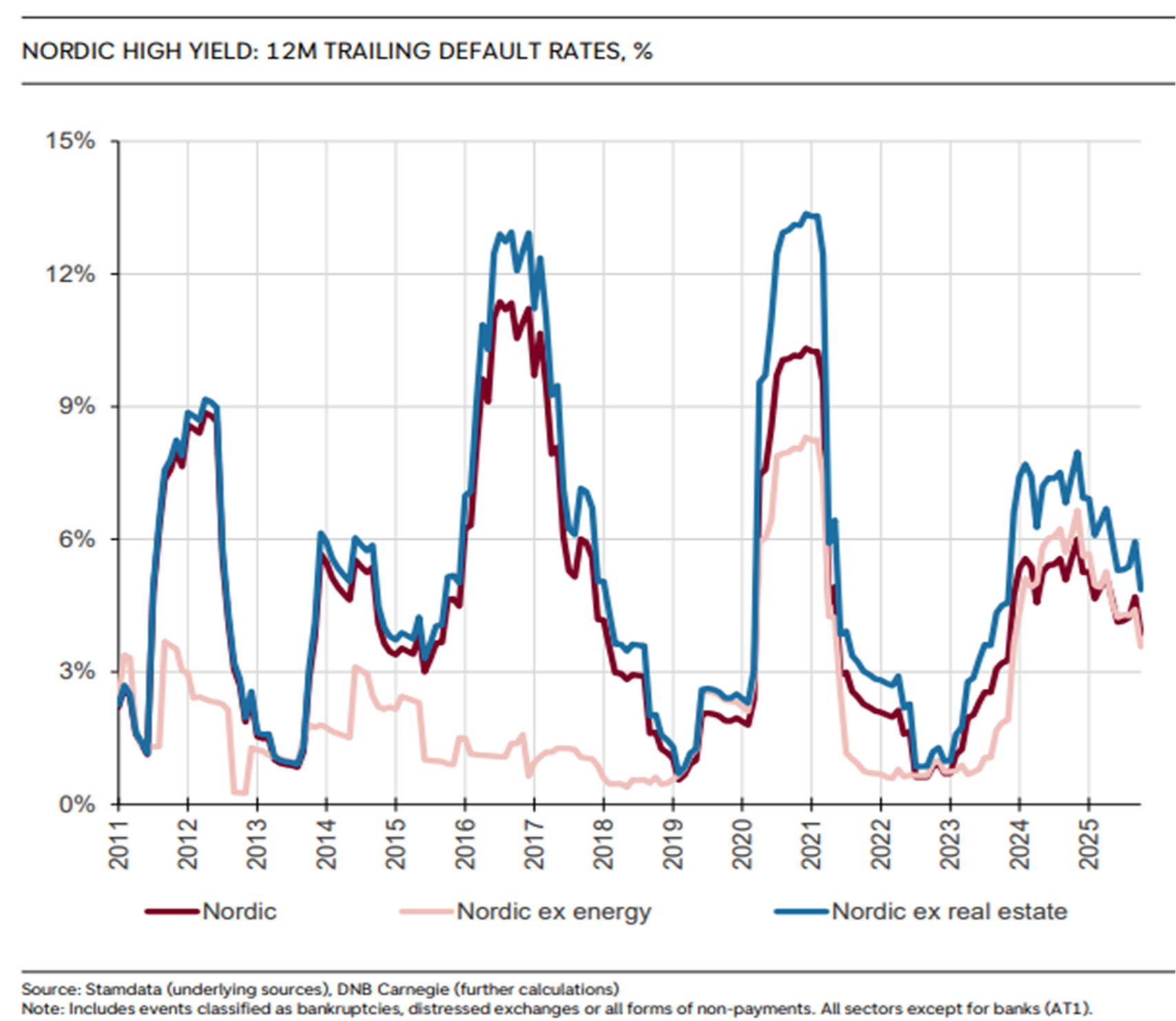

Credit spreads are somewhat expensive, reflecting decent economic growth, strong balance sheets, and lower rates. However, strong spread compression has made some market sectors—like subordinated debt—quite expensive, warranting caution. The main impact of rising refinancing costs on default rates appears to be behind us. The rate hikes of 2022/2023 led to higher defaults in Nordic high yield in late 2023 and 2024, especially in real estate and highly leveraged companies. As rates have eased and companies adjusted, defaults have trended down in 2025, with decent recovery rates. We expect defaults to continue declining over the next year.

Default and recovery rates Nordic high yield

Nordic Credit Markets: Stability and Opportunity

Nordic corporate and covered bonds are often considered particularly stable. What makes them attractive for global investors in the current environment?

The outlook for Nordic credit markets is positive. Investment grade spreads are tight, especially in higher beta segments (subordinated debt, senior non-preferred, parts of real estate), but for major sectors like senior financials, local authority, covered bonds, and utilities, spreads are near long-term medians. We do not expect further tightening but see a decent outlook for rolling IG credit over the next 6–12 months.

In Nordic high yield, spreads have widened by roughly 70 basis points in 2025, mainly due to high new issuance. This has increased the attractiveness of Nordic high yield relative to US and European markets. With default rates expected to keep falling in 2026, Nordic high yield offers a promising starting point for the coming year.

Credit spread development for different HY markets

Source: DNB Carnegie

Conclusion:

Svein Aage Aanes anticipates a year of relative stability in European fixed income markets, with moderate risks and opportunities for tactical positioning. While geopolitical uncertainties persist, resilient credit markets and improving default rates—especially in the Nordics—suggest that investors who remain vigilant and selective can find value in 2026.