DNB Fund Renewable Energy: Net potential avoided emissions impact achieved again

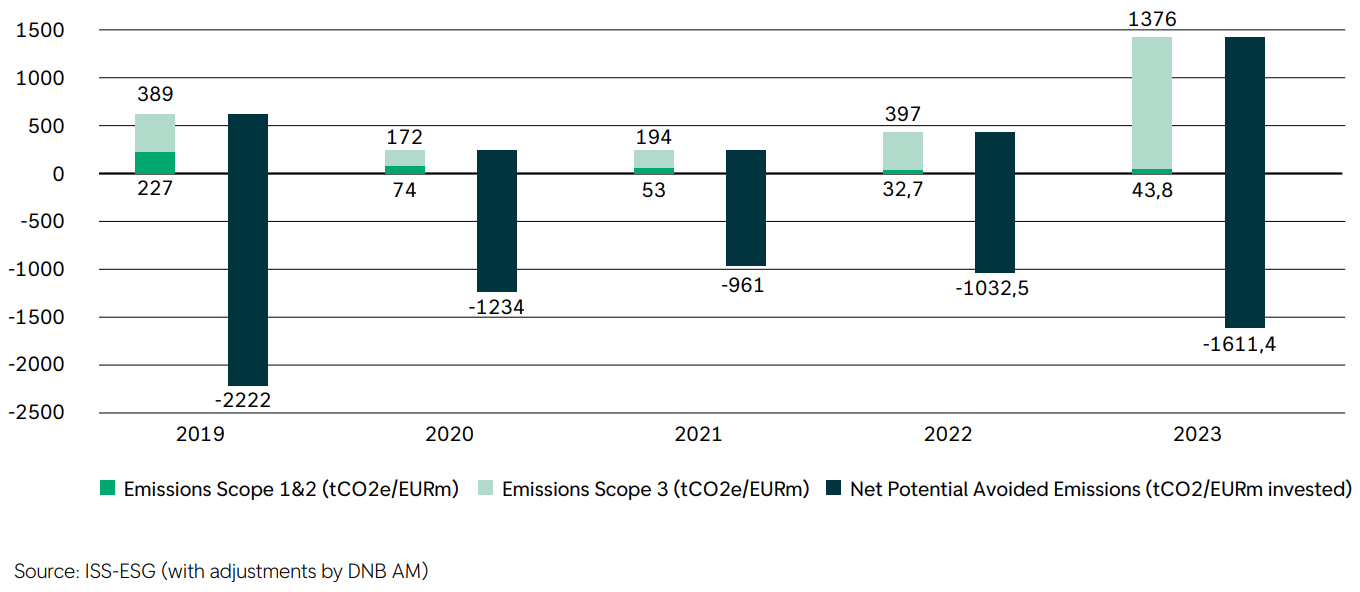

For the fifth consecutive year, our analysis based on bespoke data from ISS-ESG reveals a net Potential Avoided Emissions (PAE) result that implies that the fund potentially avoids more emissions than it emits. This consistent achievement highlights that the team has a robust investment process that successfully identifies companies providing solutions for the climate and environment.

Key drivers for this year's result and the significant Y/Y improvement includes:

- Lifetime PAE calculations: Shifting to lifetime PAE calculations instead of annual reporting has boosted results for several companies, providing a more representative view of their contributions.

- Portfolio adjustments: Greater portfolio weight in companies with high PAE contributions.

- Volume and capacity increases: Certain companies expanded their capacity and sales volumes during 2023, further enhancing their contributions.

This year’s observed increase in scope 3 is attributed to a shift in revenue calculations. For more detail, please refer to pg. 63 in the report.

Sector-level highlights include:

- Solar and wind remain amongst the largest contributors due to favourable methodologies for technology manufacturers.

- Rising to the second-largest contributor, biofuels saw strong performance from Novonesis, whose significant fund weight at the time of assessment and high PAE were key factors.

- No detractors within the power generation sector were noted this year, thanks to the fund's exit from holdings like Enel.