Due to a structural divide between investment grade and high-yield investors, large market size differences and strict and rigid rules for downgrades, Fallen Angel bonds have outperformed high-yield peers with more than 3 percent per year.

None of the underlying drivers are expected to go away so this anomaly is expected to persist.

What is a Fallen Angel?

A bond downgraded from an investment grade rating (IG) to a high yield (HY) rating is often referred to as a fallen angel (FA). IG bonds are deemed highly unlikely to default and hold a BBB- rating or higher. High Yield bonds generally have a greater risk of default and are rated BB+ or below. Investment Grade bonds also tend to have longer duration, lower coupons and weaker covenants due to more solid fundamentals.

Since IG and HY investments have different characteristics, there is a clear and structural divide between IG and HY investors and many IG investors are sellers of FAs. Rating changes are one of the most common reasons why index members’ change and FA bonds are excluded from an IG index at its next monthly rebalancing. To avoid breaches with mandates and increased tracking error, IG investors have strong incentives or are even forced to sell FAs within a short time period, creating short term price pressure.

Historically Fallen Angels have outperformed other fixed income classes

Studies going back to 1991 show that Fallen Angels (FA) underperform Investment Grade peers by 15 percent in the downgrade month and the preceding year. They then outperform Investment Grade- and High Yield peers by 10 and 6 percent over the next two years respectively.

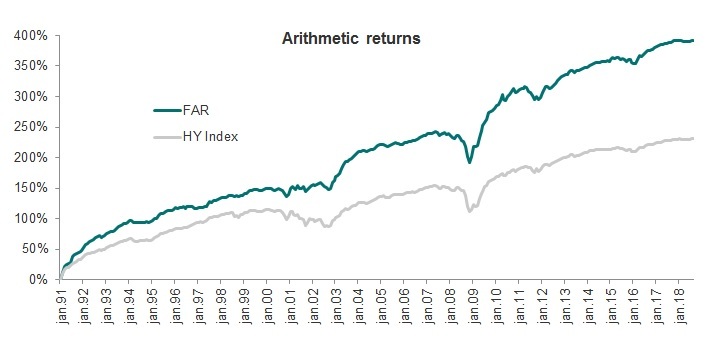

Since 1991 a naïve buy–all Fallen Angels strategy has had a 3 percent annualized outperformance over High Yield peers.

A slightly more advanced strategy, published by Ben Dor and Xu in 2011 [1], called Fallen Angels Reversal (FAR) has had a 6 percent annualized outperformance over HY peers. FAR stays away the first 3 months after the downgrade and adds a few additional risk management triggers. Volatility is higher but risk adjusted returns are better with a Sharpe ratio of 1.3 vs. 1.0 for HY peers.

What explains these abnormal returns?

The outperformance can be explained with forced selling and investors overreacting to the downgrade, causing a cliff-edge effect. Fallen Angels tend to be oversold and driven to artificially low prices, below any negative effects from information in the rating change. In such situations the Fallen Angels may drop below their fundamental value, but return to equilibrium over time.

This anomaly will keep escalating as flows into passive IG Exchange Traded Funds (ETFs) grow. Such ETFs typically become forced sellers at or near month-end, when the index rebalances.

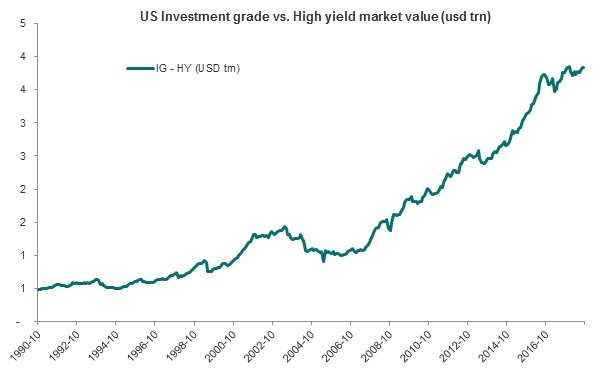

Since 2013 ETF inflows have been as large as mutual fund inflows and most of the ETF inflow is into passive ETFs. In addition, the HY market is much smaller than the IG market and when downgrades occurs, the HY market needs time and spread to absorb the bonds.

The outperformance can be explained with forced selling and investors overreacting.

The difference between the IG- and HY market has been- and is still growing. In addition to the drivers mentioned, FAs are more likely to be upgraded to IG again than HY peers. Most FAs are large brand names with better access to capital markets than HY peers allowing them to fund both operations and restructurings. Also, management are often motivated and incentivized to regain their IG rating to lower their funding costs to levels more in-line with IG peers.

Will the anomaly persist?

In spite of being a well-known strategy we expect the anomaly to persist. The IG/HY market size difference will keep growing, the structural divide between investors show no sign of going away and the market share of passive ETFs is expected to increase.

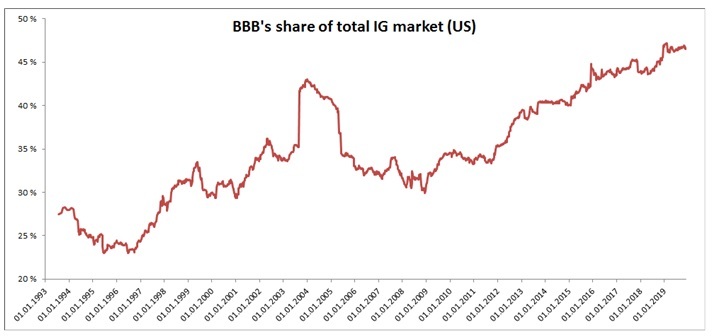

Concerning timing the universe of Fallen Angels is expected to increase due to the late stage of the credit cycle we are in. BBB rated bonds now account for almost half of the Investment Grade universe, which combined with the credit cycle may drive downgrades.

An increased opportunity set has historically been good for Fallen Angels investors, with strong returns coinciding with greater volumes. The higher quality of Fallen Angels may also provide downside protection compared to other High Yield exposure in a late cycle and January 2020 might be a good time to consider an Fallen Angels strategy.

A Fallen Angels Reversal type strategy will be a part of our upcoming Multi-Asset fund, managed by Daniel Berg and Lene Våge.

References:

Ben Dor, A. and Xu, Z., 2011. Fallen angels: characteristics, performance, and implications for investors. The Journal of Fixed Income, 20(4), pp.33-58.

Disclaimer: Nothing contained on this website constitutes investment advice, or other advice, nor is anything on this website a recommendation to invest in our Funds, any security, or any other instrument. The funds mentioned may not be available in the markets you represent. The information on this blog is posted solely on the basis of sharing insight to make our readers capable of making their own investment decisions. Should you have any queries about the investment funds or markets referred to on this website, you should contact your financial adviser.

Last updated:

Share: