First Half of 2025: Strong Returns in the Nordic Bond Market

The second quarter has been dominated by a series of major international events, which have also impacted the Nordic bond market.

Nordic High Yield

The Nordic high yield market has performed quite well over the past few years.

The combination of relatively short interest rate duration (typically around 1 year) and moderate credit duration (typically around 2.5 years) has created decent returns.

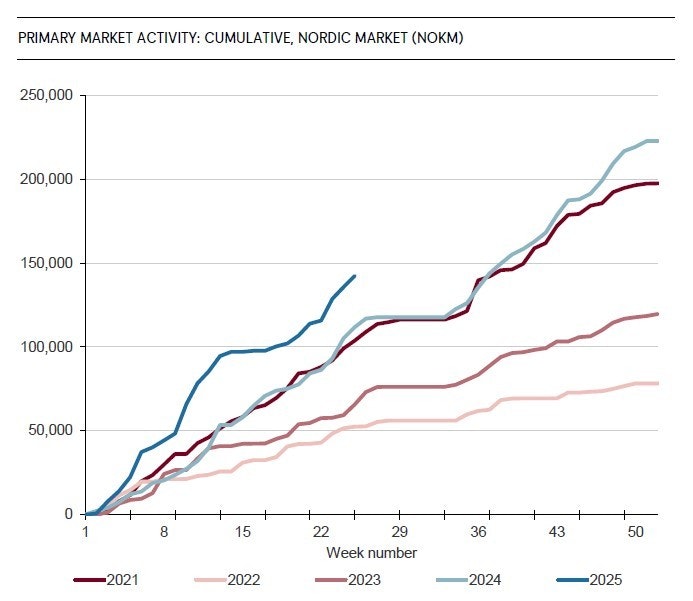

At the same time we have seen an active Nordic high yield market with strong new issuance and a continued growth in outstanding volumes and number of issuers in the market. Actually, we have seen a market growth of more than 20% since 2021 whereas both the US and European high yield markets have become smaller since 2021.

Strong performance

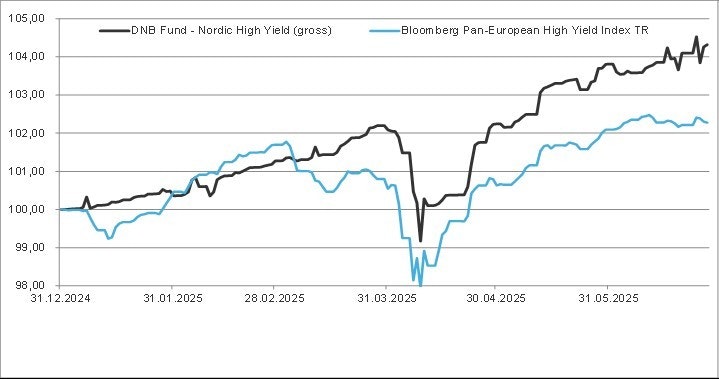

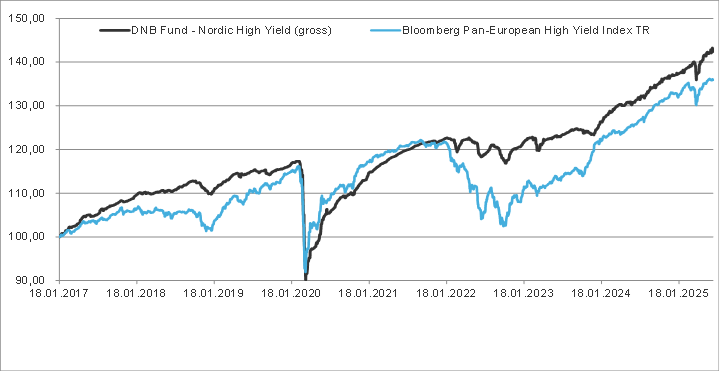

Looking at the DNB High Yield Fund performance has been attractive relative to a broad European high yield benchmark, both on a shorter and a somewhat longer horizon.

Diversification benefits

The correlation between the return in the Nordic high yield fund and European high yield is clearly positive but there will still be diversification benefits as correlation is far from perfect. There will also be positive correlation with equity market returns as the high yield and equity markets will be influenced by the same risk factors, be it geopoliticial tensions or trade policies (tariffs), But again, correlation will be far from perfect.

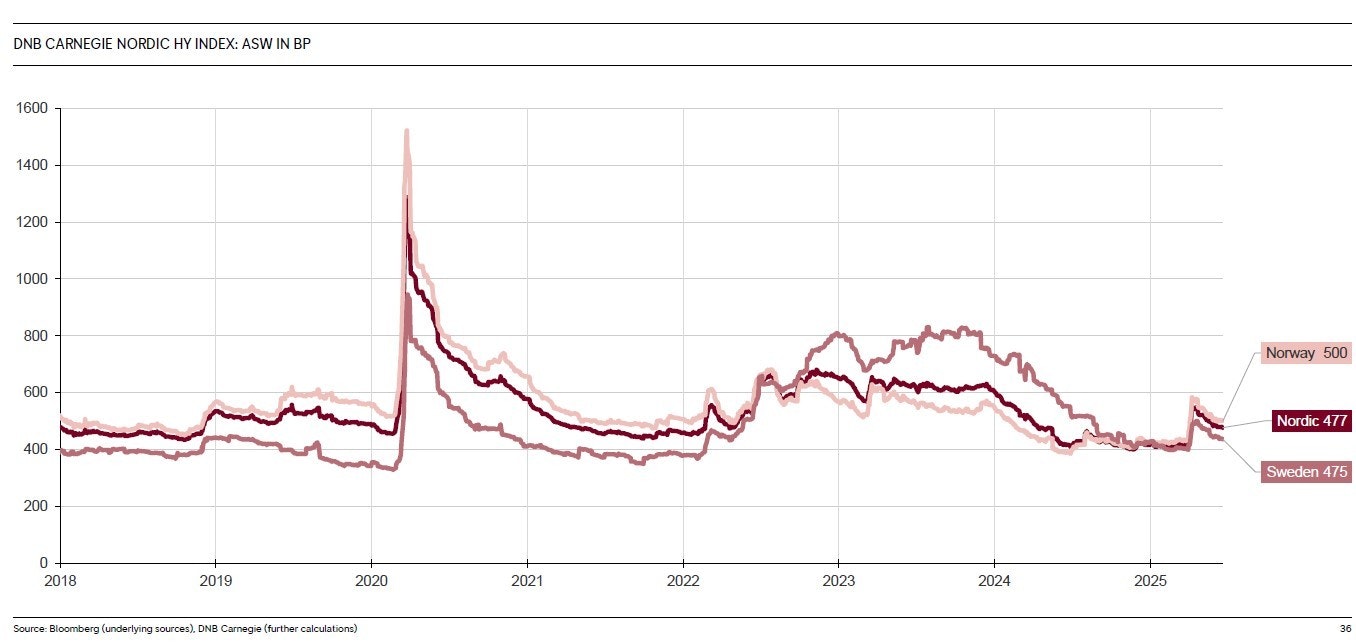

Still higher credit-spreads than pre-april

Credit spreads in the Nordic high yield market widened in early April on the new proposed tariff regime from the US. As we saw some pullback and the start of negotiations concerning tariffs we have seen credit spreads turn around and come some of the way back but spreads are still around 70 basis points higher than pre-April.