2020 was defined by the COVID-19 pandemic and the massive social and economic disruption it created, including a recession that rivalled the Great Depression of the 1930's. As tech investors it was the year where we saw the businesses that we invested in reaching a new level of mainstream acceptance as everyone in the world was, to put it mildly, encouraged to familiarise themselves with modern communication, commerce and entertainment technologies. Not surprisingly, in a year where the global stock market returned 7.0% in EUR, information technology led the way with a 32.5% return, followed by communication services at 13.4%. DNB Technology, which is benchmarked to a market weighted combination of these two indexes, returned 19.0 % gross fees, 6.7 % behind the benchmark return of 25.7%.

Source: DNB Asset Management

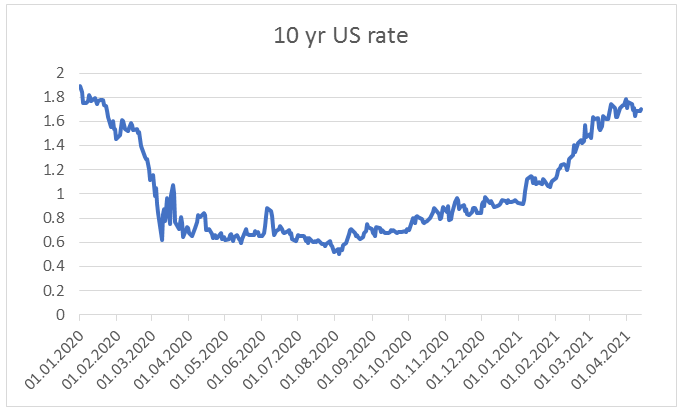

As we entered 2020, we were underweight software and services, being concerned about excessive valuation, lack of profitability and high stock-based compensation. This formed the funding for an overweight in telecom services, which was, and continues to be, attractively valued with potential positive triggers ahead. We talked about this positioning in a blog post in August last year (Are there tendencies to a Technology bubble?). We were hurt by this positioning in 2020. Both telecom and software and services formed an important backbone of keeping the wheels turning in society, but investors flocked to the latter, not paying attention to what they paid for the exposure. The second factor was monetary stimulus which lowered interest rates and increased the relative attractiveness of long duration equities, that is, stocks with the majority of earnings far into the future.

Source: DNB Asset Management

Following the news of several successful vaccines in November and the prospects of reopening long-term interest rates have returned to where they were at the start of 2020. That has fuelled an opposite effect from what we saw in 2020, with investors now leaning away from long duration assets. We have seen this effect in the portfolio too, with the underperformance from 2020 now being reversed. End of first quarter 2021, DNB Technology has returned 15.2 % gross fees, 8.0 % above the benchmark return of 7.2%.

When we build the portfolio, we do not take a view on long-term interest rates or which factors the market will favour in the short-term, be it value, momentum, growth, size or something else. Instead, we look at the bottom-up prospects of the companies in our universe and try to capture growth at the most attractive price. This approach has led us to have tilts to a variety of factors in the past and given how the market is looking today it is giving us a tilt towards value stocks.

From a top level, despite having a value tilt, the growth prospects of the portfolio are very similar to the index. On consensus forecasts our portfolio is expected to grow EBIT 19% in 2022, vs 18% for the index. EPS growth of 20% is equivalent to the index, while the medium-term growth outlook for EPS is 13%, compared to 14% for the index. Where we are different from the index is in how much we pay for this growth. Our portfolio trades a 4.1x 2022 sales, 9.8x EBIT and 17.3x EPS. This compares to the index at 8.0x sales, 18.2x EBIT and 27x EPS.

Largest Overweights |

|||

Stock |

Bet |

2022 PE |

2022 EPS GROWTH |

DEUTSCHE TELEKOM |

7.8 % |

12.5 |

12 % |

VODAFONE GROUP |

6.9 % |

16.1 |

28 % |

ARROW ELECTRONICS |

4.9 % |

10.4 |

8 % |

FACEBOOK A |

4.2 % |

21.8 |

17 % |

ORANGE |

3.9 % |

9.0 |

10 % |

CAPGEMINI |

3.8 % |

17.2 |

14 % |

WESTERN DIGITAL |

3.1 % |

10.3 |

129 % |

Vishay Intertechnology Inc |

3.1 % |

14.1 |

10 % |

Samsung Electronics Co Ltd GDR |

2.8 % |

11.8 |

30 % |

ERICSSON (LM) B |

2.8 % |

16.6 |

21 % |

Weighted sum top 10 |

43.2 % |

14.0 |

25 % |

Largest Underweights |

|||

Stock |

Bet |

2022 PE |

2022 EPS GROWTH |

APPLE |

-12.9 % |

28.1 |

5 % |

ALPHABET |

-3.2 % |

24.6 |

16 % |

NVIDIA |

-2.2 % |

45.3 |

34 % |

DISNEY (WALT) |

-2.0 % |

39.2 |

156 % |

PAYPAL HOLDINGS |

-1.7 % |

47.0 |

26 % |

ASML HLDG |

-1.5 % |

41.4 |

22 % |

MICROSOFT CORP |

-1.4 % |

31.5 |

10 % |

NETFLIX |

-1.4 % |

41.5 |

24 % |

COMCAST CORP A (NEW) |

-1.4 % |

14.9 |

26 % |

ADOBE |

-1.4 % |

37.0 |

15 % |

Weighted sum top 10 |

-29.2 % |

32.2 |

23 % |

Source: DNB Asset Management

More importantly, when we look at our five largest underweights, Apple, Alphabet, Nvidia, Disney and PayPal., these are, with the exception of Disney, businesses that have seen benefits to their core business from stay-at-home effects and we believe risks in consensus forecasts are skewed to the downside. When we contrast this to our five largest overweights, Deutsche Telekom, Vodafone, Arrow Electronics, Facebook and Orange, four out of five are likely to benefit from reopening and risks in consensus forecasts are skewed to the upside. When it comes to Facebook, we do see risk to near-term consensus forecasts as we move into reopening, however, with the stock trading at only 22x 2022 EPS, we believe we are compensated for this risk in valuation.

We look forward to the remaining three quarters of the year with strong conviction in our positioning.

Sincerely,

The DNB Tech team

Disclaimer: The information in this article is not binding. Statements in this article should not be understood as an offer, recommendation or solicitation to invest in or sell UCITS funds, hedge funds, securities or other products offered by DNB Asset Management or any other company within DNB Group or any other financial institution.

All information reflects the current assessment of DNB Asset Management, which is subject to change without notice. DNB Asset Management does not guarantee the accuracy and completeness of the information. This information does not take into account the individual investment objectives, personal financial situation or specific requirements of an investor. DNB Asset Management does not accept any responsibility for losses incurred on investments made on the basis of this information. Our general terms and conditions can be found on our website www.dnbam.com.

Last updated:

Share: