Why investing in the Nordics is a good idea

Stable political conditions and the scope of investment opportunities make the Nordic region interesting for professional investors.

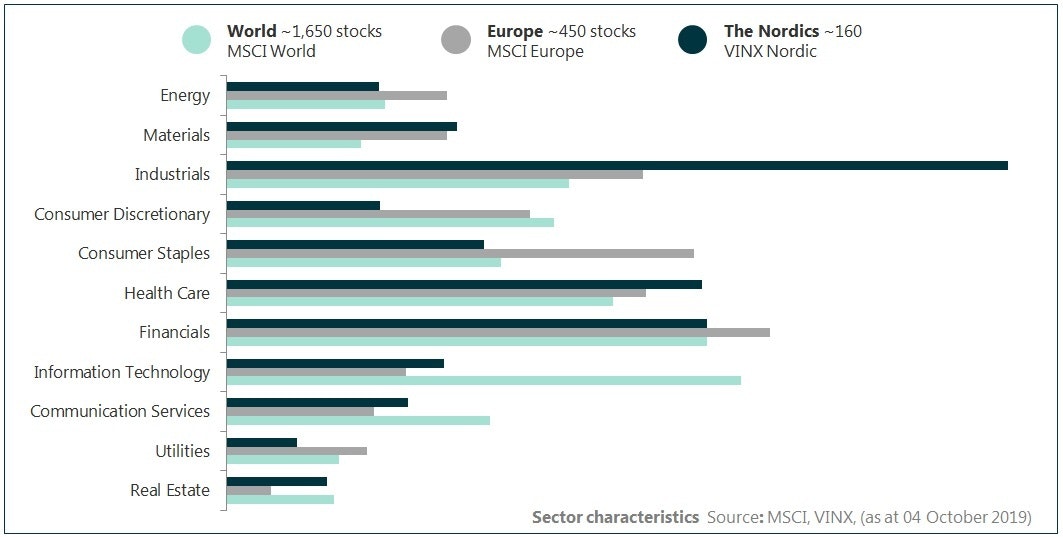

Although the Nordic region is geographically small as an investment area, nearly all the main sectors and niches of investment possibilities are represented in the Nordic stock exchanges.

The Nordic market offers a global investment universe in miniature

Each of the Nordic countries specializes in different sectors, but the Nordic region as a whole offers a wide range of diversification.

In Norway, the best investment opportunities are primarily within the energy and seafood sector whereas Sweden offers a range of strong commercial brands and export commodities. Finland is big in the material sector with its forestry companies, while in Denmark the health sector is predominant.

My point is that by investing in Nordic equities, you will achieve sufficient diversification of risk, and at the same time benefit a return potential greater than in a wider global market.

The Nordics as a region has a strong track record. The countries are innovative and the productivity is high. Last but not least, government finances are robust and stable.

This diagram shows the sectors represented in the different markets. By investing in Nordic equities, you will achieve sufficient diversification of risk, and at the same time benefit a return potential greater than in a wider global market.

Why do we think the Nordic countries will be winners in the time to come?

As an investor, you face several choices and weigh the pros and cons before you choose to invest.

The Nordic countries are not free of disadvantages; the risk in investing in a smaller market will always be higher than that in a greater market. However, we believe that the opportunities for a nice return in the Nordic Market outweigh the disadvantage.

The companies in Scandinavia, Finland, and Iceland enjoy many competitive advantages: The Nordic is characterized by a high level of education, low crime, well-developed infrastructure, strong institutions, and a good public welfare system. All in all, these factors give the Nordic countries a unique position in an increasingly tougher global competition.

The Nordics also have a clear predominance of companies that are cyclically exposed. In plain terms, this means that when the world economy is doing well, the Nordic countries are doing extremely well - and vice versa.

This graph shows us the performance of the Nordic, the European and the Global stock market during the last twenty years (based on closing prices in Euro). MSCI Nordic has outperformed MSCI World by 115% and the MSCI Europe by 155% (January 1999 -October 2019).

The Nordic market has outperformed the global market by over 100 %

During the last twenty years, MSCI Nordic has outperformed the MSCI World by 115 % and the MSCI Europe by 155 %. The Nordic countries all have very low public debt levels, highly educated labor force and score high on ESG ratings (7,6 Nordic vs. 5,8 World).

There have been many forecasts in the media these last few years, predicting that the growth will come to an end very soon. We do not share this view.

We believe in continued growth in the Nordic region. The economic situation in the Nordic countries is strong, and most of the companies in the Nordic countries are shielded from the effects of trade war and other global "noise".

Disclaimer: Nothing contained on this website constitutes investment advice, or other advice, nor is anything on this website a recommendation to invest in our Funds, any security, or any other instrument. The funds mentioned may not be available in the markets you represent. The information on this blog is posted solely on the basis of sharing insight to make our readers capable of making their own investment decisions. Should you have any queries about the investment funds or markets referred to on this website, you should contact your financial adviser.