Nordic small caps: Is the party over?

Let’s assume you invested 100 Euros in the World index at the first day of 1999. As we write mid-January 2020, you would’ve had a very satisfactory investment increase. But what if you had invested your money in the Nordics instead, more specifically in Small Caps?

As we write mid-January 2020, you would’ve happily witnessed your investment in the World Index increase to 370 Euros by now, yielding an average annual return of ca 6.4%. In other words it’s fair to say the global stock market has been a nice place to be over the past 20 years. But you already knew that…

What would have happened if you invested your 100 Euros in the Nordics instead?

If you had invested your 100 Euros in the MSCI Nordics, your account would at the same point show approximately 505 Euros, equivalent to an annual return of ca 8%. Even better!

You probably knew that as well.

Let’s however assume you invested in global small caps instead, through MSCI World Small Cap? 100 Euros would have been 775 Euros by now, returning more than 10% annually on average.

The global small cap premium has been present for the past 20 years, but this is no secret either...

What if I told you Nordic small caps do even better?

If I told you we can combine the strong fundamentals of the Nordic market and the small cap premium and come up with something even better, would you believe me?

100 Euros, imaginarily invested in MSCI Nordic Small Cap at the start of 1999, would actually be more than 1260 Euros by now, corresponding to an annual average return of almost 13%.

Against this backdrop of consistently strong returns in an attractive geographical region, we have now launched a new fund: DNB Fund Nordic Small Cap. Our aim is to create excess returns in what we consider to be the best investment universe in the world, namely Nordic small caps.

We aim to exploit this Sweet Spot

We are admittedly not the first ones plunging into this market, and probably won’t be the last. But ironically, despite the small cap space containing more gold to dig for than the large cap space, there are still fewer people digging.

In an average year, 15% of Nordic small caps rise more than 50%, while the corresponding figure for large caps is 8%. Mind also that the number of small cap companies is much higher than the number of large caps to begin with.

In spite of this, there are fewer eyes scrutinizing these small caps, with way thinner sell-side coverage and less institutional ownership. Our aim is to exploit this “sweet spot”.

A fair question to ask is naturally whether the overwhelmingly strong historical returns on Nordic small cap stocks can continue at the same pace, or whether what has gone up must inevitably come back down.

While the scientific answer to why Nordic small caps have done so remarkably well over the past 20 years is a well-kept secret, we can look at some facts and find comfort in the fundamental picture still being structurally the same. We believe this can facilitate continued strong returns in Nordic small caps.

Three reasons why we love Nordic small caps

First of all, as featured earlier on this blog the Nordic region is still a stable and largely attractive region with a lot of characteristics promoting a strong stock market.

Secondly, small caps grow faster than large caps. Comprehensive studies from around the world have been carried out to show this, and the results are valid for the Nordics as well.

Small caps grow faster than large caps.

Over the past 20 years, Nordic small caps have outgrown their large cap peers with 4pp per year on average, both on top and bottom line. The difference would naturally be even larger if we looked at the smallest companies versus the largest. And more importantly, the growth premium of small caps is expected to persist or even increase over the coming years. While the findings are neither groundbreaking nor surprising they are important; growth is an important driver for shareholder returns.

Thirdly, small caps can generate excess returns by being acquired. Of the approximately 850 Nordic takeouts we have come across since 1998, 94% of them saw a small cap company being acquired. Given the average takeout premium of 34%, this is a relevant source of alpha; as it translates into a probability that in a portfolio of 80 shares, one could on average expect three to be acquired every year.

Another comforting fact adds to the attractiveness

When answering why Nordic small caps can continue to perform well there is one fact that adds to the attractiveness: The cohort of Nordic small caps does not stay the same over 20 years. Hence, a lot of the companies driving the good performance in the past 20 years have either been acquired or transformed into large cap stocks by now. In other words, we do not have to put our faith into trees growing to heaven; we simply have to believe that today’s small caps will continue on the same note. And we see no reason why they wouldn’t.

We believe everyone should have Nordic stocks in the portfolio, both large and small caps. DNB Fund Nordic Small Cap will be an actively managed, but well diversified fund giving the investor exposure to the attractive Nordic small cap market.

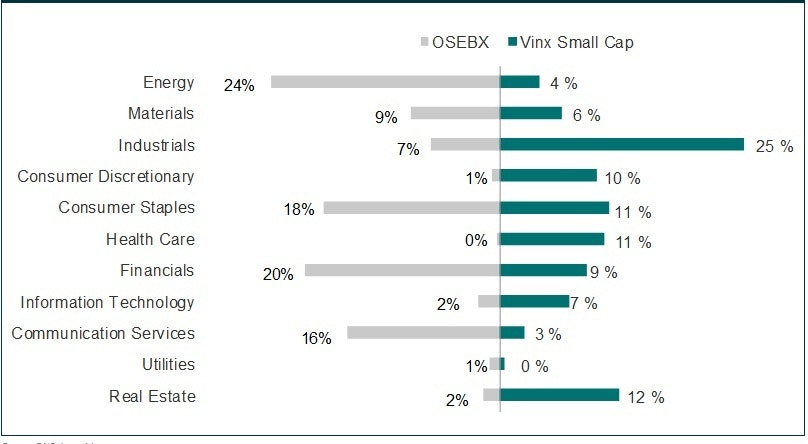

For a Norwegian investor, looking to the Nordics also yields strong diversification, as the Nordic indices contain less Energy (oil, shipping), less consumer staples (salmon), and more industry (very broad sector), technology, IT, healthcare and real estate companies. Not necessarily better, but at least quite different.

Disclaimer: Nothing contained on this website constitutes investment advice, or other advice, nor is anything on this website a recommendation to invest in our Funds, any security, or any other instrument. The funds mentioned may not be available in the markets you represent. The information on this blog is posted solely on the basis of sharing insight to make our readers capable of making their own investment decisions. Should you have any queries about the investment funds or markets referred to on this website, you should contact your financial adviser.

.