Emerging markets started on a very positive note, only to be pulled down massively by the concerns around the coronavirus pandemic. It then rallied back to new highs by the end of 2020 after strong fiscal and monetary stimulus by developed as well as emerging market countries.

The response to the pandemic has been enormous and swift and as a result we have seen a decent recovery in earnings and a strong economic outlook going into 2021. We remain confident on both an economic recovery and a good market performance from emerging markets in 2021.

Activity has rebounded sharply, and major Asian countries now have better control of Covid-infections. The vaccination drive is also looking quite positive, as most of the population is expected to be vaccinated by the end of the summer, particularly countries such as China, India and Korea.

Emerging markets have underperformed developed markets for the better part of the last 10-12 years, and we believe that the improving growth outlook – backed by some credible reforms undertaken over past few years – opens up opportunities for a catch-up.

We expect markets to perform better going forward, mainly driven by the following factors.

Currency

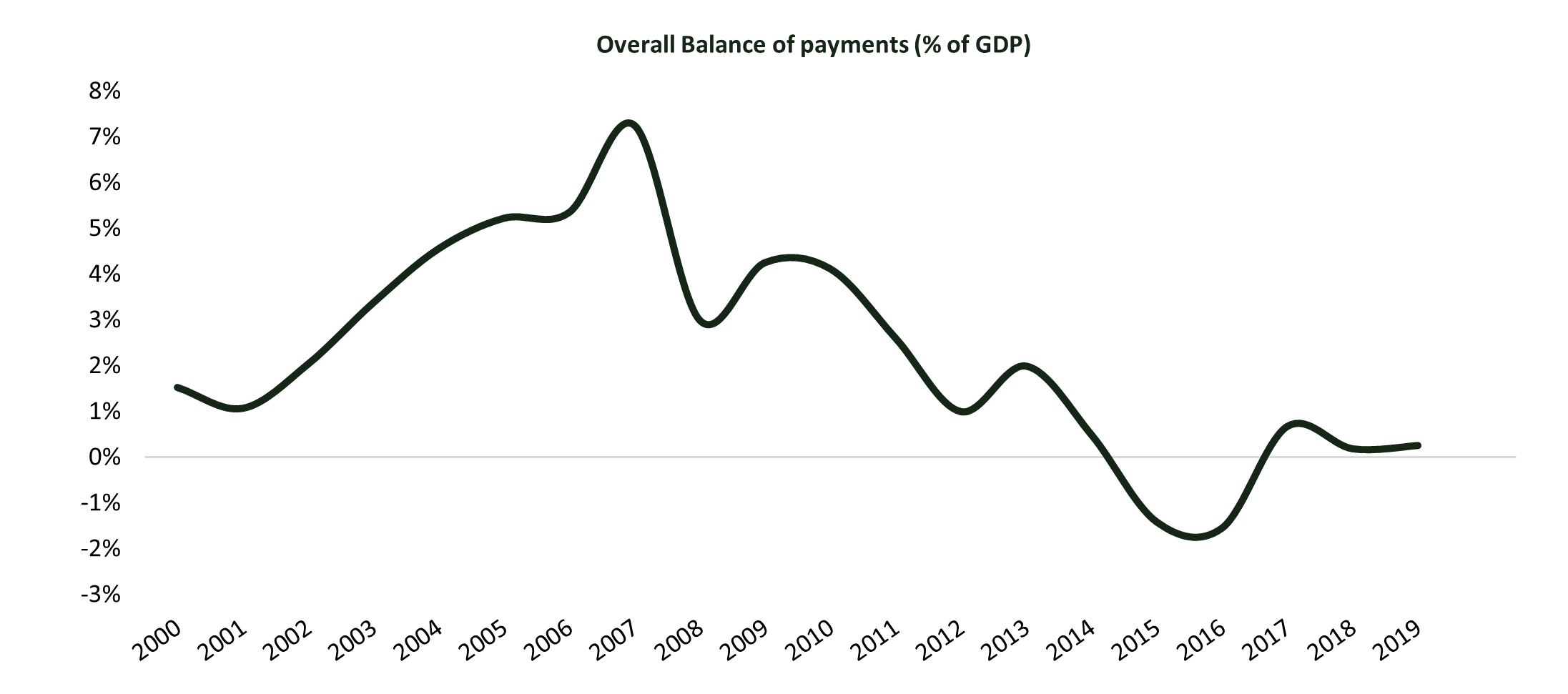

Emerging market currencies have seen a serious depreciation over the past few years, mainly due to deteriorating growth outlook, external financing pressures driven by higher current and fiscal account deficits, and rising rates in the US before the pandemic.

The situation has, however, improved meaningfully over the past 12 months with respect to current account deficits. This should lead to less pressure on financing of the deficits. While the fiscal situation remains stressed, there deterioration has been much less severe compared to that of developed markets.

The global liquidity scenario has improved considerably given monetary expansion by both the Fed and ECB, and emerging markets should attract global flows as yields still remain fairly attractive compared to the developed world.

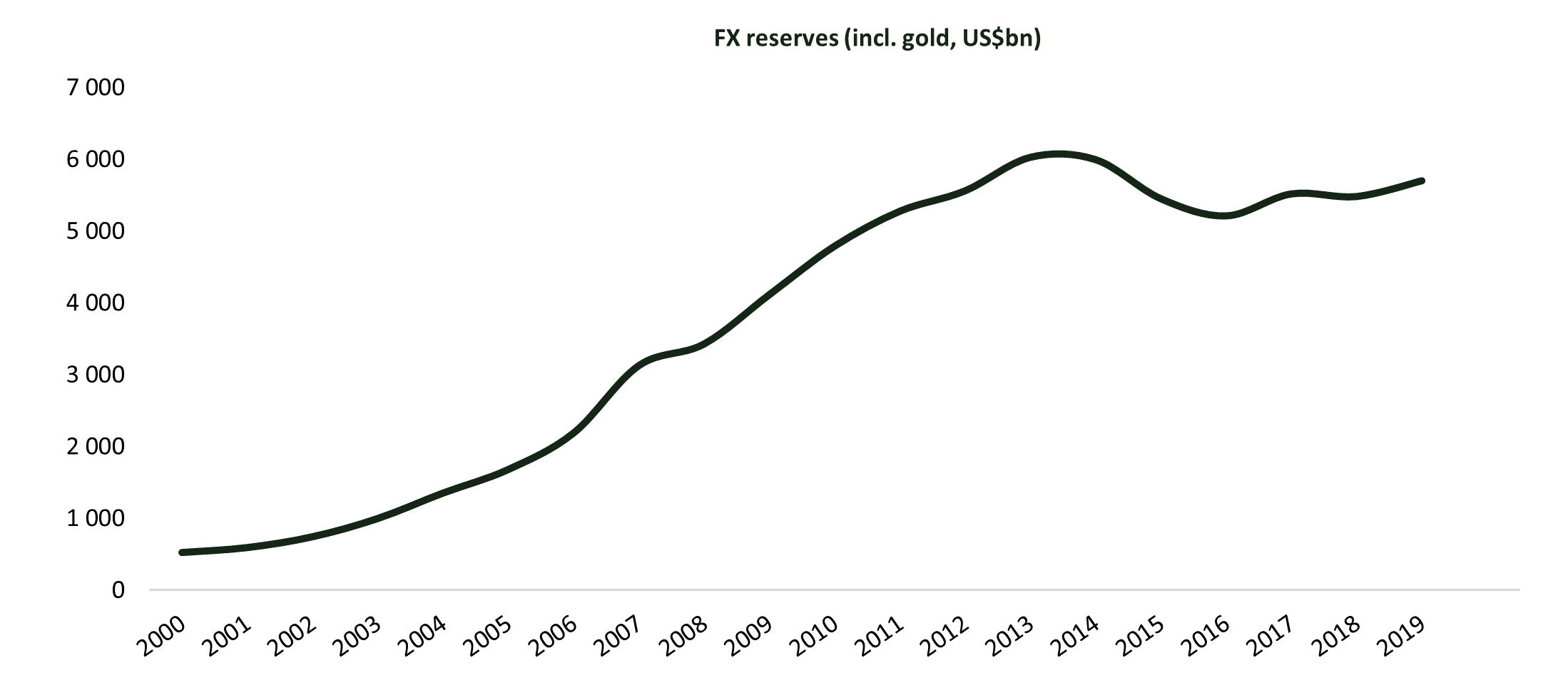

Lots of countries have also precautionarily increased their USD-reserves, giving them a decent cushion against potential currency pressures. In all, we believe USD has more room to depreciate given huge US fiscal spending and easy monetary policy by the Fed, which combined are highly beneficial for emerging markets performance.

Economic outlook

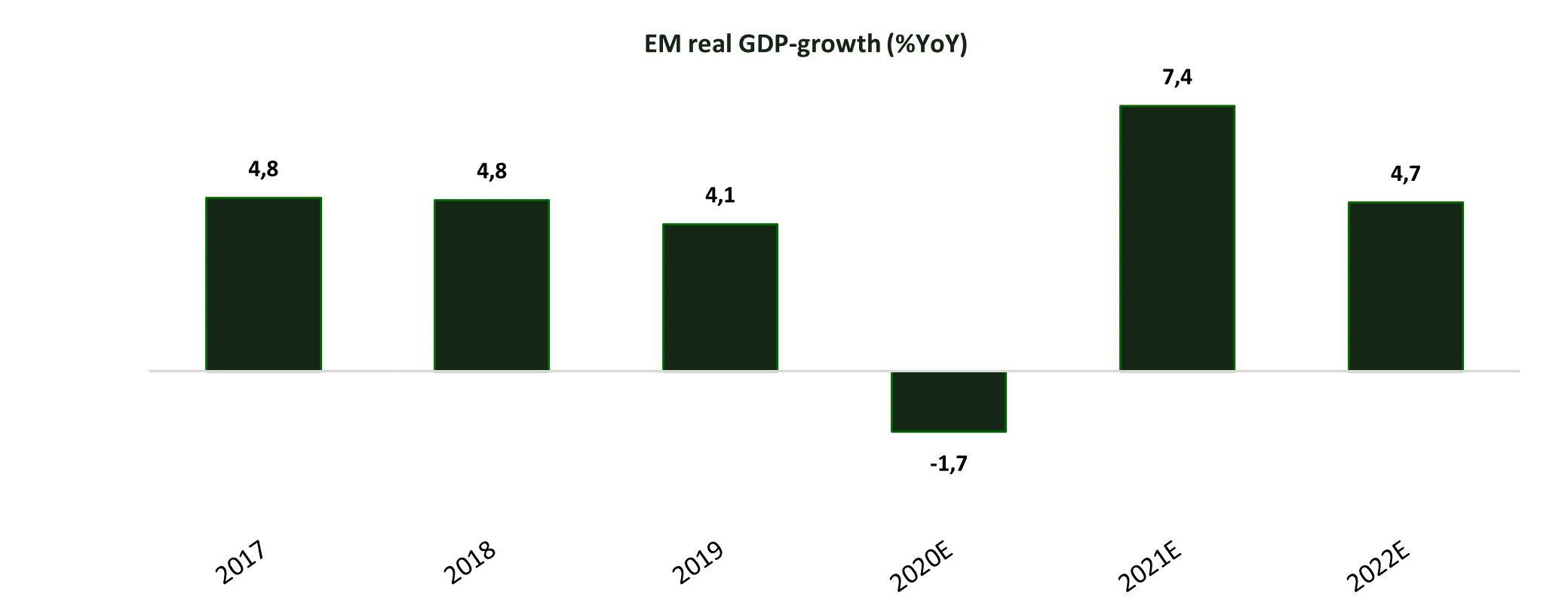

Economic outlook has improved significantly given better control of Covid-infections. The vaccination drive is also expected to improve by the end of 1Q, giving better impetus for growth to keep gaining momentum in the second half of 2021.

China was the only major economy to have positive growth in 2020, and it is expected to grow around 9% in 2021. This also gives a fairly bullish scenario for smaller ASEAN-countries, such as Korea and Taiwan, as their exports outlook should improve considerably and help these economies continue their recovery.

India has announced a decent fiscal package mainly driven by infrastructure spending. This bodes very well for capex-led growth going forward. IMF expects India to grow around 11% between April 2021 and March 2022.

Earnings Outlook

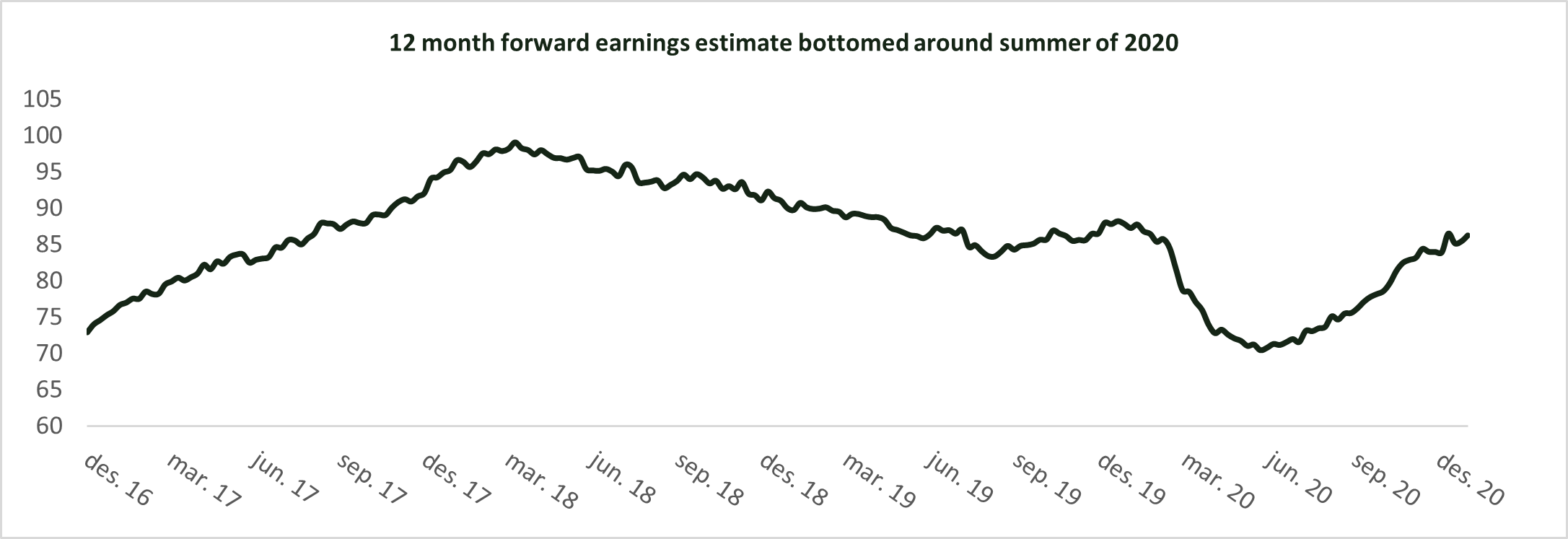

Earnings have generally been disappointing for the last few years. However, they have surprised positively for the last two quarters, as the economic recovery has been well ahead of expectations.

The size of the beats has been very encouraging and led to decent earnings upgrades. The moratoriums and other measures on debt relief from governments have helped small- and medium-sized enterprises to heal their balance sheets somewhat and prevented a lot of them from going under.

The private sector has been in a deleveraging mode for years and thus balance sheets are looking leaner and cleaner than after former crisis. Companies have managed to cut costs, and hence are now supporting better margins and profitability. We believe EM-companies have turned the corner when it comes to earnings growth and shall again deliver higher growth compared to their developed peers for 2021 and 2022.

To conclude, emerging market equities have staged a strong comeback, and after a decade of lagging behind the developed world, we believe that the conditions for excess performance are now in place.

However, in the short term we can expect some volatility to be caused by either a strengthening USD or further delays in the vaccine roll-out/effectiveness. Within emerging markets, we continue to be selective on both country allocation and stock picking as we can see clear a differentiation on the path to normalization between the economies.

The aim for the fund remains to seek companies that have weathered the storm of 2020 successfully and who will benefit from an economic reopening, in addition to having adapted well to the changes that we believe are here to stay.

Disclaimer:

The information in this document is not binding. Statements in this document should not be understood as an offer, recommendation or solicitation to invest in or sell UCITS funds, hedge funds, securities or other products offered by DNB Asset Management or any other company within DNB Group or any other financial institution.

All information reflects the current assessment of DNB Asset Management, which is subject to change without notice. DNB Asset Management does not guarantee the accuracy and completeness of the information. This information does not take into account the individual investment objectives, personal financial situation or specific requirements of an investor. DNB Asset Management does not accept any responsibility for losses incurred on investments made on the basis of this information. Our general terms and conditions can be found on our website www.dnbam.com.

Last updated:

Share: