In general, high yield bonds, commonly known as junk bonds, inherently possesses some interesting attributes as an investment class.

The obvious pros and cons

The number one advantage is income. Expected returns for high yield bonds is considerably higher than for investment grade bonds, but the risk, measured as the volatility of return, is also higher.

Expected risk and return from high yield investments on the other hand is lower than for equities. Moreover, the returns from high yield investments will typically be positively correlated with equity returns.

These characteristics naturally raises questions about the attractiveness and for what types of investors the asset class might be suitable.

Investing will always be a tradeoff between risk and return.

High yield has quite consistently been found to have attractive risk-adjusted returns

Unfortunately, the history of data for the Nordic high yield market doesn’t so far allow for meaningful, detailed analysis of risk-adjusted returns compared to other relevant investment opportunities. However, analyses of risk-adjusted returns for global or US high yield relatively consistently show that the risk-adjusted return from investments in high yield compares favorably with equities.

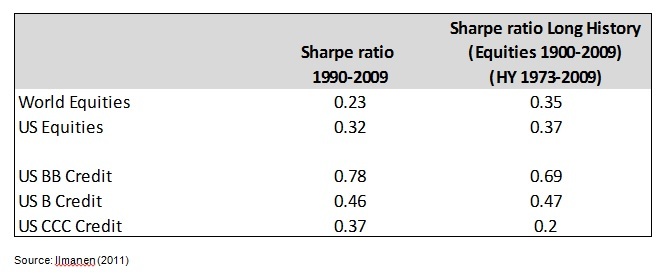

Below is a table adapted from Ilmanen (2011) which shows one measure of the risk-adjusted returns for various rating categories in the US high yield market and for global and US equities, respectively. The measure used here is the Sharpe ratio which measures the return per unit of risk (standard deviation of return).

The main driver behind the result that high yield offers attractive risk-adjusted returns is that risk (or volatility) in high yield is considerably lower than for equities.

This suggests that high yield could be suitable for investors seeking attractive returns with a limited downside, relative to equities.

Of course, it is important to be aware that the upside is also capped in high yield relative to equities.

You may also want to read: Fallen Angels, the Last Free Lunch?

What should be the time horizon for investors in Nordic High Yield?

The observation that volatility is considerably lower for high yield than for equities does not imply that the risk in high yield is particularly low.

Volatility in a high yield fund is markedly higher than in an investment grade fund. This suggests that this type of investment is suitable for investors with a medium to longer term investment horizon.

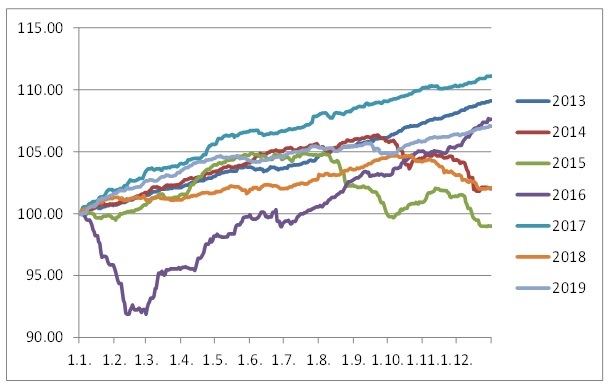

To illustrate the variability of returns in Nordic high yield the following figure shows the annual return in NOK (net of fees) since the inception of DNB High Yield and the development of returns in each individual calendar year.

Annual return and return development for DNB High Yield since inception:

Returns have varied between -1% and 11.1% over this time period and the figure shows that there are periods of relatively sharp drawdowns (although they are smaller than typical drawdowns in the equity market).

To increase the probability of harvesting attractive returns investors should thus have a relatively long time horizon for their investment in this asset class.

Can Nordic high yield work as a diversification for international investors?

We have now concluded that high yield bonds could make sense for investors with medium to long term investment horizons looking for attractive risk-adjusted returns, i.e. attractive expected returns relative to the variability of returns over time. Nordic high yield could also make sense for investors who already have exposure to European or US high yield and are looking to diversify this exposure.

There are two elements to this diversification.

High yield bonds make sense for investors with medium to long investment horizons

First, Nordic high yield gives access to issuers and exposures that will typically not be found in European or US high yield portfolios, so there is an element of issuer diversification.

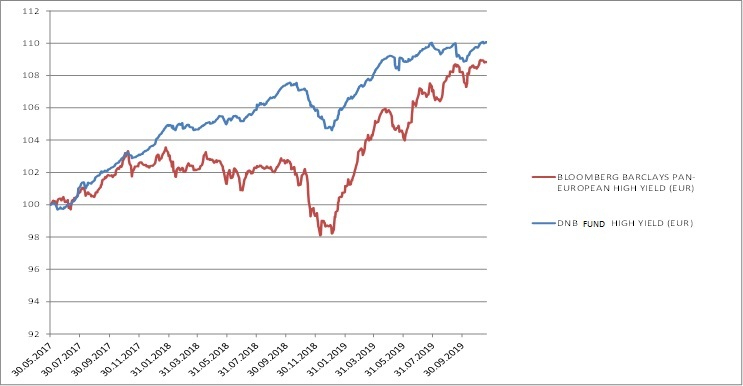

Second, there will also be diversification in returns, i.e. Nordic high yield could contribute to stabilizing returns in an overall portfolio. Although the Nordic high yield market will clearly be correlated to other high yield markets globally, this correlation is not perfect. In addition, the last few years have shown that volatility in the Nordic high yield market is quite low, see the figure below.

An additional benefit for international investors is that this diversification does not come at a cost. With the present market pricing there is actually a considerable pick-up in yield going from US or European high yield into Nordic high yield.

Nordic high yield bonds are available through our DNB Fund High Yield.

Disclaimer: Nothing contained on this website constitutes investment advice, or other advice, nor is anything on this website a recommendation to invest in our Funds, any security, or any other instrument. The funds mentioned may not be available in the markets you represent. The information on this blog is posted solely on the basis of sharing insight to make our readers capable of making their own investment decisions. Should you have any queries about the investment funds or markets referred to on this website, you should contact your financial adviser.

Last updated:

Share: